APAC Coal Limited (AAL.ASX) is raising $15mil through the issue of 75 million 20c shares for coal exploration purposes. The issue is scheduled to close on the 15th May 2008 and the listing of shares on the 5th June 2008.

I am excited by the prospect of another coal explorer given the high coal prices. I should remind shareholders that I recommended Pike River Coal (PRC.NZE) about 8 months ago on the basis of its attractive coking coal mine development in NZ. I'm pleased to see its now up to $1.25, and no doubt going higher. NZ coal is actually pretty good, though the seam characteristics are not as appealing as Australia. The infrastructure is a bit patchy given the proximity to port, as only an island could be. Sorry for the digression.

Reading the prospectus for this company, one would have to say it has some appeal, but its a high risk proposition. The company is buying a coal concession in East Kalimantan, an established coal production area, for a $A40 million vendor consideration. This would not be an unreasonable amount in alot of cases, BUT consider:

1. They have outlined only a very small resource

2. The coal is very high in ash, thus low in calorific value

There are some positive factors as well:

1. The project area is very close to a port, though it such a tight coal market I doubt whether any operator would have room for such high ash coal. so from a strategic and marketing angle, this report has alot of holes for cockroaches to crawl through.

2. The coal has the capacity to be washed to produce a higher energy coal with lower sulphur. Notwithstanding that fact, this is pretty shit coal. It has an ash content of 30%. I dont think I would mind that so much if there was coal washability test results to add confidence. Regardless, there is the prospect of high grading the coal onsite, though there would be a lot of ash and fines generation I dare say.

3. The coal actually suits mine mouth power station generation, unfortunately there is little electricity demand in Kalimantan, since its one of the least populated islands. So the question is - couldn't domestic and export mines find a better quality coal than 30% ash? with high sulphur. Afterall there are billions of tonnes. I wonder what they are mining, or whether they are smoking it.

4. The coal is lower grade sub-bituminous coal. That explains why this coal concession is being offered. The company is confident they can increase the calorific value by washing it. Well duh! But that costs money. They make the claim that washing will reduce the sulphur content of the coal. Maybe true, but that assumes the sulphur is tied up in the ash to be liberated and not in the coal. there is no washability testing, so how are we to know. Maybe they excluded that data because the results were negative. But Indonesian coal is already considered low-sulphur, so no benefit there.

5. I like the fact that they have a large concession area of 68,360 hectares, as it offers at least the possibility of resource potential. Pity that they have done so little work on it. I guess that is reason to believe its no better than what they currently have, so I downgrade it. No coal quality data, seam thicknesses.

6. They already have 5.1Mt of coal outlined...a small amount but useful. There are two potentially economic and open pittable coal seams within the project area. Exploration data indicates that the upper seam (A seam) ranges in thickness from 2.19-2.88m and the lower seam (B seam) from 3.95-8.13 metres. These are not bad thicknesses of coal given the opportune timing of this issue (high coal prices), its preparedness to start coal mining, its proximity to coal loading facilities and export markets. Given the faulting/thrusting and relatively steep dips though, i'm inclined to think there is little more mineable coal.

7. Hidden seam - they briefly talk about a 3rd higher calorific value (6266kcal/kg) seam. i guess that is much deeper, so not open cut.

This prospectus strikes me as ill-prepared, or maybe its just that ASIC has low standards and ASX could care less. Why is there no coal washing tests, no market study by Barlow Jonker. Well consider they offer a price comparison with Indonesian reference coal prices, but they are on a different basis, one air dried, the other gross as received. confusing. Nice if they could standardise energy basis, as well as allow a discount for high sulphur coal.

They do make the point that the coal can be blended with higher energy coal at the port, which is a great strategy if there is a shortage of coal, as there is now. The problem is this is shockingly bad coal with 37-39% ash, as well as being very high in sulphur as well (1.4-2.4%S). It is true this coal does make sense as a domestic coal, particularly for a fluidised bed boiler, which can readily accept all types of coal. the location of the coal is good. Have they done any testing on the washability characteristics of the coal?

The independent consultants believe the coal could be upgraded by washing. So where is the simple testing to verify? Christ, sounds like someone is trying to sell me a 'boiled lollie'. Haven't had one of those in a while. Another unattractive features is the 20degree dip of the coal, which is going to reduce readily accessible open cut resources.

Nine coal outcrop positions have been recorded by the geologists for the 890 km2 area. These outcrops have been logged but not sampled. I wonder whether it was because the coals are not worth it.

In the case of this independent report, I suspect the consulting geologist spent little time proof reading his work since he states "The reported grades, tonnages and contained ounces may

be rounded to two significant figures in accordance with recommendations of the JORC Code". Usually we dont describe coal in ounces.

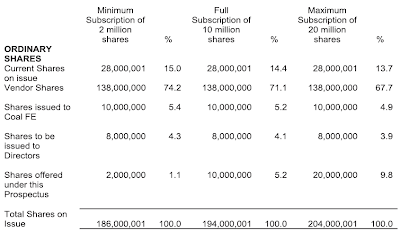

Magnus Energy, the Singaporean vendor is receiving 200mil shares for its interests - thus valuing them at $40 million. The question is - are the projects worth that much? I hope they are talking $HK rather than $AUD, as the project value strikes me as worth $5-10mil rather than $40mil. Hope shareholders dont mind the dilution. The vendor period is 2 years. I wonder if they are allowed to short the stock. I think company directors are coming up with clever ways to get around the laws. There is always a financier out there prepared to facilitate them. Silly world we live in.

-----------------------------------------------

Andrew Sheldon

www.sheldonthinks.com