Welcome to ASX Stag Party!

Wondering what the hell I am talking about?

ASX Stag Party is a website dedicated to reviewing and recommending new stocks as they list on the Australian Stock Exchange (ASX). A great many of these stocks are lemons, so a great deal of critical thinking will be applied to find the cherries.

Why stag party? Well stag profits refers to the profits that you can make on new listings, often referred to as Initial Public Offerings or simply as 'IPOs'. Party refers to the celebrations that you will be invited to if you have shares in one of our winning stocks. Sorry, we don't celebrate losses.

I hope you like the site.

New upcoming IPOs on the ASX

IPO Name Code Planned Listing Date

1. Argent Minerals Limited (ARD) 3 April 2008

2. Chrysalis Resources Ltd (CYS) 18 April 2008

3. Eastern Iron Limited (EFE) 21 May 2008

4. Gemstar Diamonds Ltd (GEM) 12 May 2008

5. Handini Resources Ltd (HDI) 28 April 2008

6. Mallee Gold Corporation (MLC) To Be Announced

7. Queensland Mining Corp (QMN) To Be Announced

Warranties & Disclaimer

The information presented here is offered in good faith however no warranty can be made as to its accuracy or its completeness. The information is not intended to constitute a basis for your decision making, thus you should seek independent third party advice as well as consult the original prospectus documentation before investing.

The author does engage in considerable speculation as to the circumstances and events which may or may not pertain to the subject matter in hand. This speculation is done in the interests of public knowledge. Please make your own investigations to establish the veracity of the information. You have a right to know the facts. My intent is to open doors, not to slam them in people's faces. Ask questions, not defame characters.

Introduction

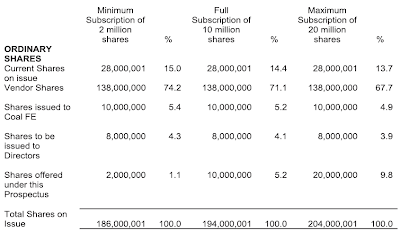

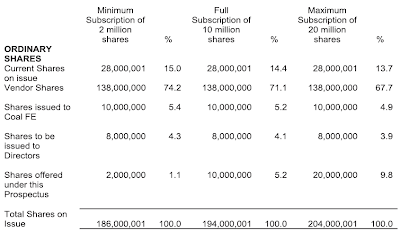

IntroductionHandini Resources Limited (HDI.ASX) is an IPO that is due to be listed on the ASX on the 28th April 2008. The company plans to use the proceeds from the capital raising to fund diamond exploration. The company is raising $5 million before costs by issuing 10 million shares, and have provisions for an extra $5 million (10mil shares). In addition there are already 138 million vendor shares allocated to the seed investors and project sponsors, resulting in a post-IPO issued capital of between 186-204 million (average 194mil). Assuming the stock enters the market at 50c (par value), that gives the stock a market value of $97 million.

The company's website is

www.handiniresources.com. The offer closes 14th April 2008 so you will need to download your prospectus and despatch the application form.

Management

I dont know the management of this company but have no doubts about their capacity to undertake their proposed strategy. The doubts I have arise because of the lack of commercial sense for investors.

Projects

Handini Resources in July 2005 acquired a 60% stake in a 30-year coal concession in Jambi Province, Sumatra, Indonesia. The contract of work (COW) has a JORC-compliant proven reserve of 22.9mil tonnes, plus a probable 1.1Mt. The greater resource inventory is 31.7Mt Measured and 5.2Mt Indicated. The company commenced mining in March 2006, and in the 7 quarters since the company produced 1.4Mt of coal. The company is planning to use the proceeds to fund the expansion of production from 1.2Mtpa to 2.5Mtpa. There was a significant scaling up in production from May 2007, which might give investors confidence. My concern however is that that higher output was motivated by opportunism rather than long term sustainability. Power stations have been struggling to secure coal supplies of late. I read recently that National Power Corp in the Philippines was facing a shortage. The implication is that prices are now VERY HIGH, so its a good time to sell a mine, particularly one that lacks resources. My concern is that export only makes sense at these very high prices.

The coal project comprises 2 very small concessions really, so I dont see scope for a significant increase in resources, though they might be able to secure more leases. That task does however become more difficult when thermal coal prices are so high. I'm sure its a roaring trade to convert Indonesian 'rupiah' into AUD, so there are likely a lot of deals being done.

Stock Outlook

When I first glanced at this prospectus I thought "Great...finally a good company...a company developing an exciting project in an exciting market". But this is far from that. I was disappointed, and tend to see the IPO as an opportunity to divest rather than fund exploration or development since the company is already in production at a time of high coal prices. You might ask. Wouldn't they raise more money if they wanted to divest. I think not because that would reflect badly on the issue if it failed to get subscriptions. That is a risk if you attempt to raise too much money.

There is a vendor escrow period period to consider - see page 14, part 2 of the prospectus. This was not adequately explained to me. The Indonesian government has its own regulations as far as equity is concerned.

Basically the aspects I dont like about this company are:

1. Small resource base with little possibility of increase because of small title area

2. Long development lead time for domestic coal supply to a power station

3. High truck haul through the mountains to Padang export terminal - and its high moisture coal. 4. The high valuation implied by the vendor consideration of $97 million

The positive aspects about this company are:

1. The coal is well-suited to mine-mouth power station feed. That is however a longer term proposition and open to greater competition. Details on the Indonesian government's plans to expand domestic coal supply. The company is taking the sensible strategy of investigating a mine-mouth power station, which is consistent with the government’s plans to expand output. The problem is that power stations take years to plan & build. I would think 3 years minimum for a small plant, and possibly 5 years if you consider that there is likely to be a backlog of orders for turbines, fluidised boilers, etc. 2. Coal prices look like staying high for some time, though new supplies are destined to become available from Australia, Indonesia and China, and we are looking at some global softening. One might argue that the tight supply of equipment in mining & power generation will actually crimp the demand for coal significantly.

It is difficult to place a valuation on this company without knowing their mine costs, and more importantly their transport costs to port, particularly given the very high cost of fuel. The company has not provided an independent assessment of the value of the project. I woulds think my former employer Barlow Jonker would be coal consultant able to perform that for them. It might have supported their IPO....but maybe not.

So thumbs down on this one for me.

Introduction

Introduction

No comments:

Post a Comment